Conventional 97 loan calculator

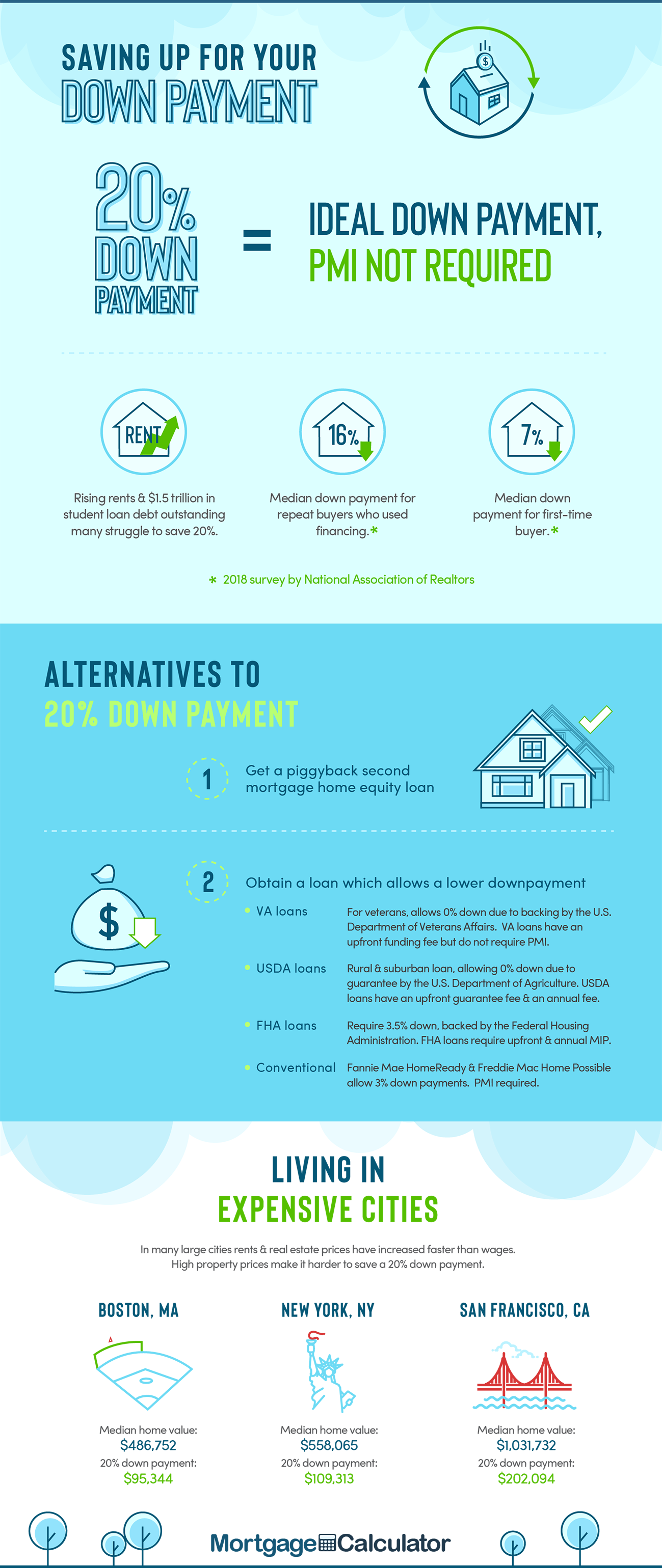

PMI is 05-1 of the loan amount per year. Fannie Mae has approved mortgage lenders to offer a HomeReady lending program that only requires a 3 down-payment.

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

It will then estimate your total expected closing costs.

. Use this calculator to estimate your monthly home loan payments for a conforming conventional home loan. Home Construction Loan Calculator excel to calculate the monthly payments for your new construction project. Low down payment.

Mortgages require only 3 down for. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. As of 2022 the maximum conforming limit for single-family homes throughout the US.

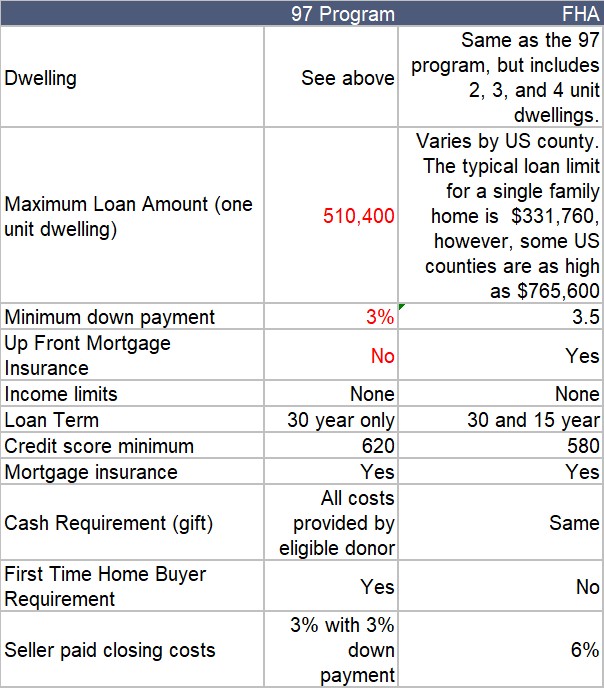

Short on cash they lead to problems when managed improperly. If your credit is good but your ability to save up a downpayment is limited a Conventional 97 loan might be a good choice for you. Typical banks want at least a 3 down-payment PMI to insure loans.

Conventional Loans Fannie Mae and Freddie Mac Programs 3 Down Fannie Mae and Freddie Mac government-sponsored enterprises that buy and sell most US. Conventional 97 loan. Refinancing into a conventional loan lets.

3 minimum requirement for a 97-3 loan. Furthermore this mortgage option was developed to help foster economic. Your annual MIP rate would be 070 percent for the life of the loan.

This calculator allows you to select your loan type conventional FHA or VA or if you will pay cash for the property. Get in touch by phone via our online form or by post. Whether you are building your own house or getting a loan for home improvement the home construction loan calculator will calculate the monthly loan payments with an amortization table and chart that is exportable to an excel.

In a conventional real estate deal the sellers agent buyers agent each receives a share of the total realtor commission fee after the sale closes. And conventional loans offer lower mortgage rates the higher your credit score is. Use our calculator above.

The program can be used by first-time repeat home. The average cost of private mortgage insurance or PMI for a conventional home loan ranges from 058 to 186 of the original loan amount per year according to Genworth Mortgage Insurance. A lens is a transmissive optical device which focuses or disperses a light beam by means of refractionA simple lens consists of a single piece of transparent material while a compound lens consists of several simple lenses elements usually arranged along a common axisLenses are made from materials such as glass or plastic and are ground and polished or molded to a.

Put 10 percent or more down on a 30-year loan. Loans with a 3 down-payment are called Conventional 97 mortgages. Youd pay an annual MIP of 08 percent for 11 years.

Real Estate Commission Calculator Loan Calculator. Check Your USDA Home Loan Eligibility. You can generate a similar printable table using the above calculator by clicking on the Create Amortization Schedule button.

Use loan payment. Is actually legible for USDA housing programs. Mortgage loan basics Basic concepts and legal regulation.

Using the same FICO loan savings calculator in the example above heres how much the calculator estimated youd spend on interest in total based on credit score. Need to generate an amortization schedule for a 30 year fixed-rate conventional loan. Land mass meets the USDAs standard for a rural area.

A mortgage in itself is not a debt it is the lenders security for a debt. 760-850 score 84000. Make sure to check their website to know the current loan limits.

Some lenders may include certain fees that make conventional loan rates more competitive. Advanced Estimated Closing Cost Calculator Conventional FHA VA More. For example if your loan amount is 620000 your mortgage is considered a conforming conventional loan.

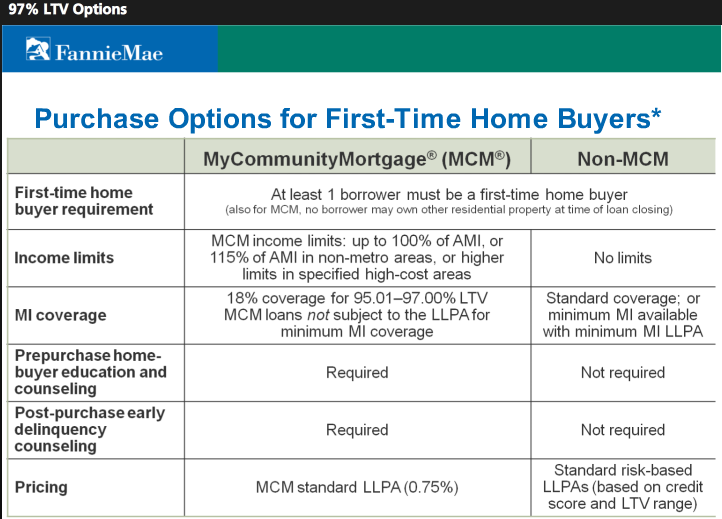

Unlike a low-downpayment FHA mortgage Conventional 97s use traditional PMI policies. Your annual MIP rate would go down to 08 percent for the life of the loan. View 97 LTVCLTVHCLTV financing options that help you serve qualified first-time home buyers and support the refinance of Fannie Mae loans.

Your credit history and credit score will also impact the rate you will receive. Its a 3 down payment program and for many home buyers its a less. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

This 3 down conventional mortgage works for first-time and repeat home buyers with no income limits Fannie Mae HomeReady loan. Get a 15-year loan instead of a 30-year loan. These can be canceled at a future time after the loan passes an 80 loan-to-value LTV ratio.

Conventional loan 97 3 down The Conventional 97 program is available from Fannie Mae and Freddie Mac. From the 10 down piggyback loan to 3 down HomeReady and Conventional 97 loans low-down-payment options not only exist but are extremely popular with todays conventional loan borrowers. In many cases balloon amounts are refinanced into conventional amortizing loans as they come due spreading the payments out further.

ADUs can be financed using a range of Fannie Mae loan options and allow borrowers the flexibility to earn rental income from tenants or provide additional space for extended family. The conventional 97 loan also lets you put just 3 percent down while FHA requires 35 percent at minimum. A photovoltaic power station also known as a solar park solar farm or solar power plant is a large-scale grid-connected photovoltaic power system PV system designed for the supply of merchant powerThey are differentiated from most building-mounted and other decentralised solar power because they supply power at the utility level rather than to a local user or users.

Continental baseline is 647200. This 3 down conventional mortgage helps new. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. If youre comparing the same points and mortgage rates for an FHA loan and a conventional loan the conventional loan may usually have a lower rate. While rural housing may sound like a limitation 97 percent of all land in the US.

About 97 of the US. Conforming limits are adjusted every year by the FHFA. Put 5 percent down on a 30-year loan.

Use amortizing loan advantages to keep budgets manageable.

Fha Loans Versus Conventional 97 Mortgages

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Fannie Mae Conventional 97 Ltv Mortgage California Mortgage Broker

Conventional 97 Loan And Calculator Anytime Estimate

Conventional Mortgage Calculator What Is A Conventional Home Loan Prequalify Calculate Your Monthly Payments Today

Conventional 97 Loan 3 Down Home Loans Usa Mortgage

Fha Loans Vs Conventional Loans Fha Loans Conventional Loan Mortgage Process

X142neyu2y31 M

Fha Vs Conventional Loans Pros Cons To Both

Current Fha Home Loan Rates Fha Mortgage Rates

Conventional Loan 3 Down Available For Buyers Of 1 Unit Homes

Home Loan Downpayment Calculator

Fannie Mae 97 Conventional Mortgage Loan Is Back Prmi Delaware

Conventional Mortgage Calculator What Is A Conventional Home Loan Prequalify Calculate Your Monthly Payments Today

Conventional 97 Loan And Calculator Anytime Estimate

Usaa Mortgage Review 2022 Smartasset Com

Conventional Mortgage Calculator What Is A Conventional Home Loan Prequalify Calculate Your Monthly Payments Today